by Senior Scene | Mar 31, 2024 | Community, Featured Article (02), General Interest, Magazine

The One Command of Jesus Rev. Jeff Wood, First Presbyterian Church of Sebastian WeLoveFirst.org & Facebook.com/welovefirstsebastian Thirty six times a particular phrase comes up in the New Testament. Repeats are important, a way of saying, “Heads...

by Senior Scene | Mar 31, 2024 | Bonus Article, General Interest

Lessons from 13,000 Feet By Jay Ahlbeck, jayahlbeck@gmail.com I am not an alpinist or a mountain climber, but last summer, I traveled to Zermatt, Switzerland, to climb the 4,164-meter Breithorn. Reaching the peak of the Breithorn was the goal; however, the...

by Senior Scene | Mar 31, 2024 | Featured Article (06), General Interest, Magazine, Senior Health, Veteran News

Will Medicare pay for medical marijuana? by: Brenda Lyle The short answer is no. Cannabis, although legal in Florida as medical marijuana, is still illegal according to the Federal Government and has not been cleared by the Food and Drug Administration. Your primary...

by Senior Scene | Mar 31, 2024 | Community, General Interest, Local History, Magazine, Top Story (Cover)

Local Artist Diane Larson Diane Larson has been sailing and painting for most of her life, in the Pacific, the Atlantic and Caribbean. From San Francisco to Mexico, from Maine to the Caribbean and everywhere in between. She works from her studio on the Space Coast...

by Senior Scene | Mar 31, 2024 | Around the House, Featured Article (05), General Interest, Magazine

Is it possible to use AI on my smartphone and if so, how do I do it? By James Bowman, Data Rescue Yes, it is possible to utilize AI capabilities on your smartphone. Many smartphones today come with built-in AI features, and there are also numerous AI-powered apps...

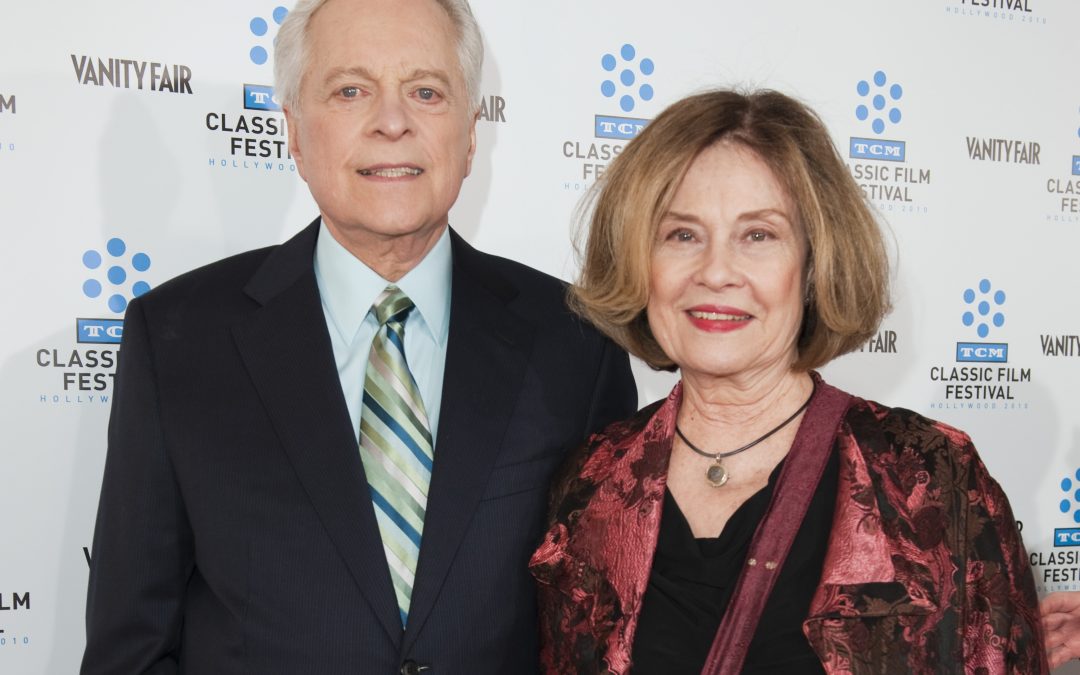

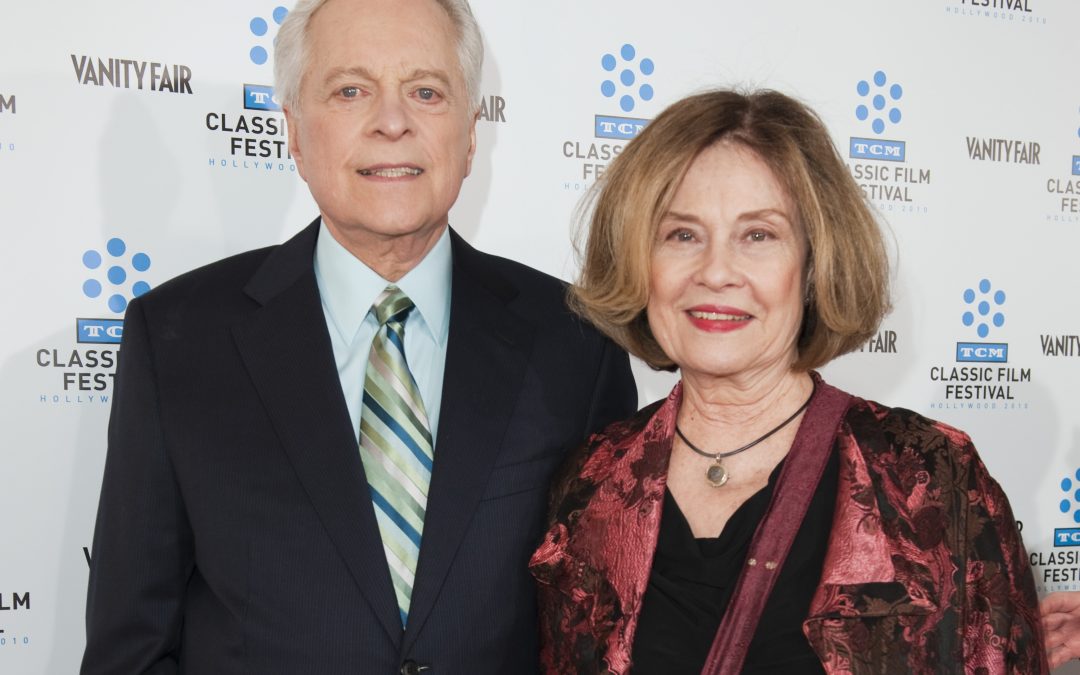

by Senior Scene | Mar 31, 2024 | Celebrities, Entertainment, General Interest, Magazine, Nostalgia, Top Story (A)

Diane Baker remembers TCM host Robert Osborne By Nick Thomas The 15th Turner Classic Movies Film Festival is scheduled for April 18-21, in Hollywood. Canceled for a couple of years due to the pandemic, no one was more pleased to attend the festival when it resumed in...

Recent Comments